Choosing the right forex trading platform is crucial for both beginners and experienced traders. The right platform can enhance your trading efficiency, minimize risks, and maximize profits. This guide provides a step-by-step approach to selecting the best forex trading platform based on your trading style, experience level, and financial goals.

Understand Your Trading Needs

Before selecting a platform, consider the following:

- Experience Level: Are you a beginner, intermediate, or advanced trader?

- Trading Style: Do you prefer scalping, day trading, or long-term investing?

- Market Access: Are you interested in major currency pairs, exotic pairs, or CFDs?

- Budget: What is your initial capital and risk tolerance?

Features to Look for in a Forex Trading Platform

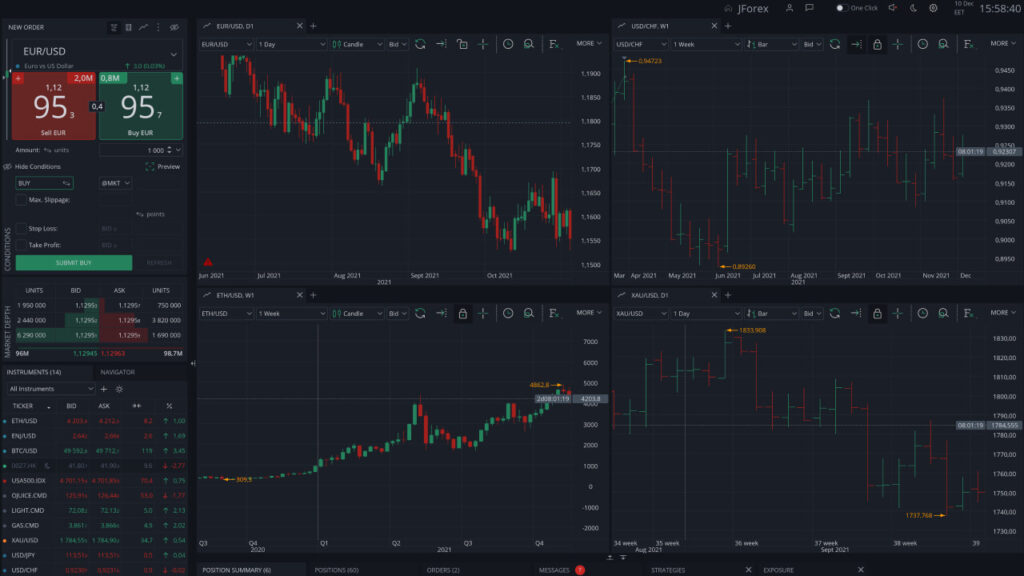

User-Friendly Interface: A good forex platform should have an intuitive interface that allows easy navigation and quick execution of trades.

Regulation and Security: Ensure that the platform is regulated by a recognized financial authority such as:

- US: Commodity Futures Trading Commission (CFTC)

- UK: Financial Conduct Authority (FCA)

- Australia: Australian Securities and Investments Commission (ASIC)

- Europe: Cyprus Securities and Exchange Commission (CySEC)

Trading Tools & Indicators: Look for platforms that offer essential trading tools like:

- Advanced charting tools

- Technical indicators (Moving Averages, RSI, MACD, etc.)

- Economic calendars and news updates

- Auto-trading and algorithmic trading capabilities

Spreads, Fees, and Commissions: Consider the cost structure of the platform:

- Fixed vs. Variable Spreads – Variable spreads can be lower in stable market conditions but may widen during volatility.

- Commission-Based vs. Commission-Free – Some platforms charge commissions per trade, while others make money through spreads.

- Deposit & Withdrawal Fees – Check if there are additional costs for transactions.

Leverage and Margin: Leverage can amplify profits but also increases risk. Check the leverage options offered by the platform:

- 1:30 (for retail traders in Europe)

- 1:50 (for US traders)

- 1:500 (for professional traders in certain regions)

Execution Speed & Reliability: Fast execution is crucial in forex trading. Look for a platform with:

- Low latency execution (especially for scalpers)

- Minimal slippage

- Stable uptime during high volatility periods

Mobile & Web Compatibility: A good trading platform should be accessible on:

- Desktop (Windows, Mac)

- Mobile apps (Android, iOS)

- Web-based platform (for browser access)

Customer Support: Reliable customer service is essential. Ensure the platform offers:

- 24/5 or 24/7 support

- Multiple contact options (live chat, phone, email)

- Support in your preferred language

Comparison of Popular Forex Trading Platforms

Platform | Regulation | Minimum Deposit | Spreads | Mobile App |

|---|---|---|---|---|

MetaTrader 4 (MT4) | FCA, ASIC, CySEC | Varies by broker | Variable | Yes |

MetaTrader 5 (MT5) | FCA, ASIC, CySEC | Varies by broker | Variable | Yes |

cTrader | FCA, ASIC | $100 | Tight spreads | Yes |

NinjaTrader | NFA, CFTC | $400 | Low commissions | Yes |

eToro | FCA, ASIC, CySEC | $10 | Commission-free | Yes |

Common Mistakes to Avoid

- Choosing an Unregulated Broker – Always check for regulation before depositing money.

- Ignoring Fees & Spreads – High costs can eat into profits.

- Overleveraging – Using too much leverage can wipe out your account quickly.

- Neglecting Customer Support – Poor support can be frustrating during technical issues.

- Not Testing with a Demo Account – Always try a demo before committing real funds.

Expert Tips for Selecting the Best Platform

- Start with a demo account to test the platform’s interface and execution speed.

- Read user reviews and testimonials to check for common complaints.

- Consider the broker’s reputation and how long they have been in business.

- Check the withdrawal process to ensure easy access to your funds.

Our Recommendation

Selecting the best forex trading platform depends on your experience level, trading goals, and platform features. Beginners may prefer user-friendly platforms like eToro, while advanced traders might opt for MT4 or cTrader for their advanced tools. Always prioritize regulation, security, and ease of use to ensure a smooth trading experience.

Frequently Asked Questions

MetaTrader 4 (MT4) and eToro are great choices for beginners due to their user-friendly interfaces and educational resources.

Many platforms offer free accounts, but trading involves costs such as spreads, commissions, and withdrawal fees.

Check the platform’s official website for regulatory licenses or verify directly on the financial authority’s website.

MT4 is best for forex trading, while MT5 offers additional features like stock and commodities trading with advanced tools.

Yes, most major platforms like MT4, MT5, and cTrader offer mobile apps for trading on the go.

It varies by broker, but some platforms allow trading with as little as $10.

Trade only with regulated brokers, read reviews, and avoid platforms promising guaranteed profits.

Leverage allows traders to control larger positions with a smaller deposit, increasing both potential profits and risks.

Yes, most platforms provide demo accounts to practice trading without real money.

Consider factors like regulation, fees, trading tools, ease of use, and customer support before making a decision.

Ranjan is a dedicated finance writer for smartfinclub.com, where he specializes in comparing top financial products in India, including loans, credit cards, savings accounts & more. With a focus on providing clear insights into features, rates, and benefits, Ranjan aims to empower readers to make informed financial decisions customized to their needs.